Weathering the Essential: A Look Inside the COVID-19 Impact on the Waste and Recycling Industry

June 8, 2020

After several months in quarantine, America is beginning to slowly reopen; restarting the economy and attempting to put more than 30 million unemployed Americans back to work. Unlike other viruses and diseases, COVID-19 seemingly came out of nowhere, spreading quickly, overwhelming some hospital systems and sending the U.S. through its supplies of personal protective equipment (PPE), masks, hand sanitizer, toilet paper and ventilators. A novel, highly contagious virus, scientists continue to identify new symptoms and work toward a vaccine.

Although states are now beginning to lift restrictions, Americans have sat at home, finding freedom on local greenways or parks rather than movie theaters and bars. Local eateries have been closed, group events like concerts and sports have been postponed or canceled and retail stores have sat empty, aside from those managing curbside pickup.

While a number of industries have slowed to a halt, many waste industry employees find themselves on the frontlines, essential to our daily lives protecting human health and the environment. While being essential means staying operational, it is not without its own set of challenges, such as changes in the waste stream and keeping employees safe.

With Americans staying home and businesses producing less waste, how has the industry been impacted?

The Environmental Research & Education Foundation (EREF) and the National Waste & Recycling Association (NWRA) initiated a survey to learn how the industry has been affected and how it has dealt with the new challenges. The survey was sent to a database of waste industry employees or an affiliated field, such as solid waste academia.

SURVEY RESPONDENT DEMOGRAPHICS:

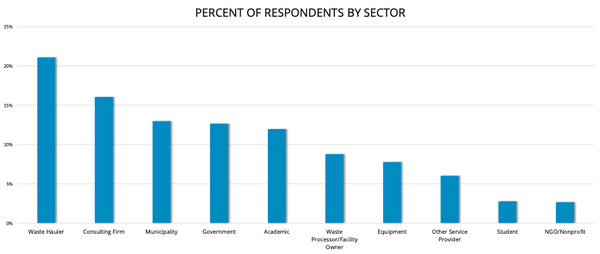

EREF received nearly 400 responses. As can be seen in Figure 1, waste haulers were the predominant respondent, representing more than a fifth of all responses.

Figure 1

KEY OUTCOMES

The following five sectors represented three-quarters of the respondents in this survey (Figure 1):

Waste haulers (21 percent)

Consulting firms (16 percent)

Municipalities (13 percent)

Government agencies (e.g., state/federal) (13 percent)

Academic institutions (12 percent)

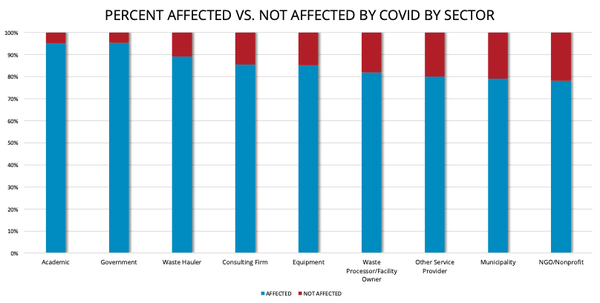

While all sectors included in this survey reported being impacted by the pandemic (Figure 2), academic institutions were among the most impacted, which, given that most of them shut down for the spring semester, is not surprising. While some academic research is able to continue remotely, many of the laboratory experiments may be set back, delaying research results indefinitely. Government agencies and waste haulers rounded out the top three with around 90 percent of respondents in these sectors indicating impacts.

Figure 2

In the next three to nine months, staffing is anticipated to account for the greatest short-term impact, followed by supplies and changes in contracts. As for the long-term impacts (i.e., those extending to 2021 and beyond), staffing issues and supplies are expected to be of continued concern, and renewal of contracts are expected to account for 25 percent of company concern. This mirrors increasing commentary and economic forecasts that suggest the longer it takes to deal with the pandemic, the longer it will take for the economy to recover.

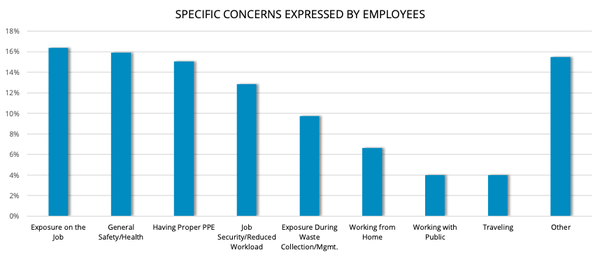

One-fifth (20.8 percent) of respondents indicated that employees had not expressed concerns related to their health at work. Of those who did, employees were most concerned about exposure to the virus while working. This includes exposure from contagious employees, interactions with vendors and an inability to remain socially distant.

The top five concerns expressed by employees were (Figure 3):(Note that the below are concerns of possible issues, not verified issues.)

Exposure on the job

General concern of safety/health or fear of catching the virus (not particularly job-related)

Having proper PPE and related supplies

Job security or reduced work hours

Exposure during waste collection/management

Figure 3

While municipal employees were more vocal about their concerns about the coronavirus, one-third of waste haulers who responded to the survey received concerns from employees about exposure risks during collection and management of municipal solid waste.

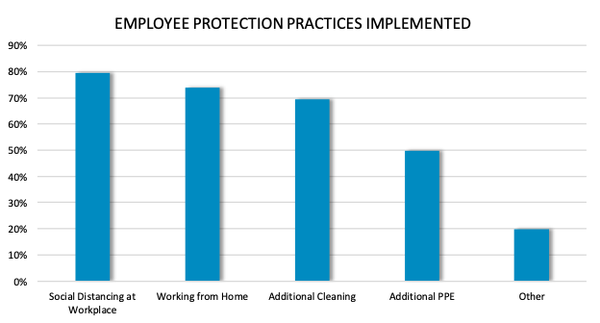

Social distancing at the workplace, working from home and implementing additional cleaning and sanitizing measures were the top practices used by companies to keep employees safe (Figure 4). Two-thirds of employers have implemented three or more measures to protect employees, while fewer than 1 percent have implemented no measures. Some companies allow employees to work from home, obviating the need for some of these practices, such as social distancing.

Figure 4

*“Other” includes change in work practices, modified/suspended services, increased communication/education, routine health checks, increased hygiene, general and travel restrictions.

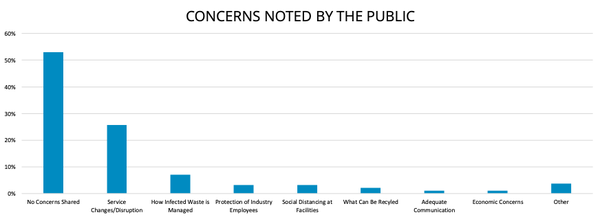

When asked what concerns the public was sharing with the solid waste field related to COVID-19, 53 percent of companies indicated that their customers had few or no concerns relative to waste management. Of concerns noted, the majority of respondents received questions regarding whether their waste would be picked up and if convenience/drop-off centers would be open. A limited number of respondents were concerned how the employees would protect themselves from waste infected with COVID-19 (Figure 5).

Figure 5

*“Other” includes exposure from waste services/facilities, general fear/concern and lack of regulatory inspections/review.

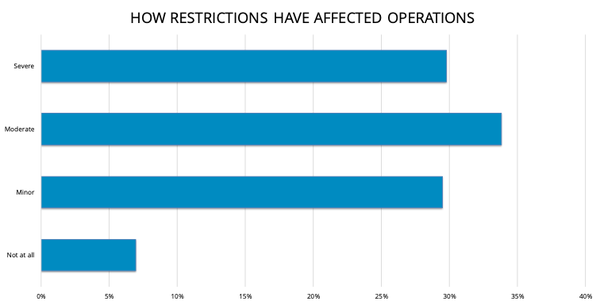

As for impacts to revenue and waste volume, approximately two-thirds of respondents noted they have faced moderate to severe operations impacts due to COVID-19 restrictions, while fewer than 10 percent indicated no affects at all (Figure 6). The vast majority of respondents (more than 70 percent) expect revenues to decrease, while about 23 percent expect revenues to remain the same and a few expect revenues to increase. The majority of those indicating unchanged revenue include government agencies, students, academic institutions, consulting firms and nonprofits/nongovermental organizations. About 6 out of 10 of haulers/waste managers experienced a decrease in volumes, while nearly 3 in 10 actually managed more material and the remainder were unchanged. This reflects the decline in commercial waste from the closure of offices, retail spaces and restaurants contrasted by the increase in residential waste from being quarantined. Unfortunately, increased volumes do not necessarily translate to attendant rise in revenue as many residential contracts are fixed price.

Figure 6

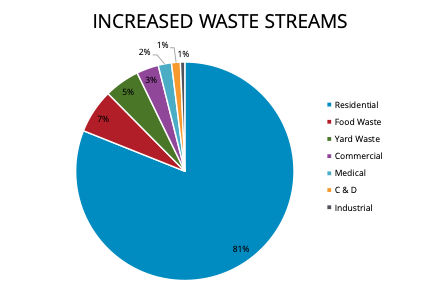

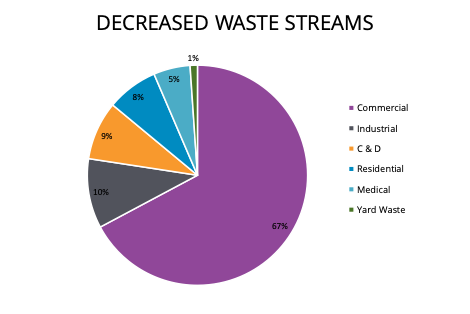

Nearly 70 percent of respondents indicated they saw changes in specific waste streams, with residential waste expectedly undergoing the largest increase. The remaining 30 percent consisted of food, yard, commercial, medical, construction and demolition (C&D) and industrial waste, in that order (Figure 7). On the other hand, 67 percent of respondents saw a decrease in commercial waste (Figure 8).

Figure 7

Figure 8

Contrary to what some might expect, more respondents noted a decrease in medical waste than an increase. Anecdotal observations via discussions with medical personnel suggest that while localized COVID-19 “hotspots” could result in increased medical waste volumes, the majority of the U.S. has seen reductions in medical waste. Healthcare workers suggest this could be due to a large portion of the population working at home, which may impact the frequency of situations requiring medical care. Elective surgeries were canceled and telehealth services have increased. Many doctors and dentists closed their offices to routine care and are only now beginning to reopen. In addition, COVID-19 patients do not generate significant amounts of medical waste. (April 2020)

Despite the changes in volume of the waste streams, 83 percent of survey respondents indicated that they are not handling any waste differently.

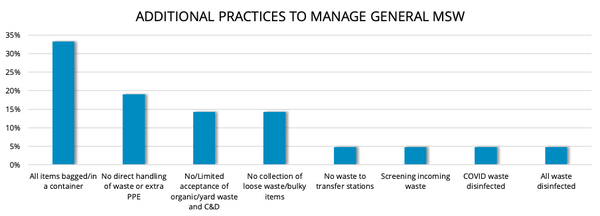

Of those who are managing waste differently, general municipal solid waste is being managed differently more often than recycling or medical waste streams due to COVID-19 concerns (Figure 9). The top four changes being made in how waste is managed are:

Requiring waste to be bagged or in a container

Limiting or restricting staff from handling waste or requiring additional PPE for handling materials

Banning or limiting acceptance of organics, green wastes and C&D

Stopping or reducing bulky or loose item pickups

Figure 9

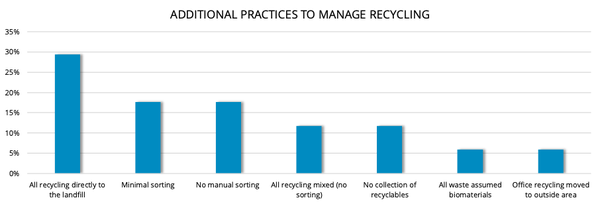

There have been alterations in the way that recycling is being handled. In some instances, recycling is being sent directly to the landfill or minimal sorting is occurring. Some stopped any manual sorting, and others allowed all recyclables to be mixed stopping all sorting. There were a few instances where recycling was stopped completely (Figure 10).

Figure 10

Since the pandemic began, industry publications, as well as NWRA and EREF, have tracked COVID-19’s impact on the industry, and the findings across the board are quite similar.

One of the main consistencies is that waste haulers have been most affected. This has been apparent since the coronavirus started spreading in the U.S. but was further confirmed in the first quarter earnings results.

The publicly-traded companies reported that they have faced challenges including volume declines, residential volume increases, staffing, contracts and revenue declines. However, the impacts have not been as bad as initially feared, according to industry reports and quarterly earnings calls with investors. This data falls in line with more than 70 percent of survey respondents seeing or expecting to see a decrease in revenue; 81 percent of respondents indicating an increase in residential waste; staffing accounting for the greatest short-term impact amongst respondents; short-term impacts such as revenue reduction and work-at-home challenges being the most common; renewal of contracts accounting for 25 percent of respondents’ long-term impacts; and two-thirds of respondents noting that they are facing moderate to severe operations impacts due to COVID-19 restrictions.

Another top comparison amongst industry surveys is notable changes in the waste streams. Nearly 70 percent of respondents indicated they saw changes in specific waste streams, with residential waste seeing the largest increase. This is mostly due to the fact that many businesses are closed due to shelter-in-place orders, and many people are using this time to clear their homes of clutter.

While all 50 states have begun reopening, many opening in phases, the waste and recycling industry is preparing for possible reinfection and a second wave of the coronavirus by making changes to resiliency plans, which existed before COVID-19 made its appearance.

With resiliency plans in place, more safety measures being taken and best practices learned, the industry will remain strong well into the future, even if life as we once knew it takes some time to return.

About the Author(s)

You May Also Like