Unpacking the Evolving Role of Producers in the U.S. Recycling System (Part 1)

A a three-part series features graduate student research from the Yale School of Forestry & Environmental Studies exploring the economic problems with packaging in the U.S. recycling system. Part one focuses on addressing systemic recycling problems in the United States.

July 13, 2017

In a three-part series, graduate student research from the Yale School of Forestry & Environmental Studies explores the economic problems with packaging in the U.S. recycling system. Part one focuses on addressing systemic recycling problems in the United States.

Financial stress in the U.S. recycling industry has triggered, at times, heated dialogue between waste management providers, government, and consumer product companies (producers) that put single-use materials onto the market. The economic viability of recycling is under question, and new government and industry initiatives are emerging to try to fix a system whose profitability is primarily driven by commodity prices. Among the lowest recovery rates in the developed world, at around 34 percent[i], recycling in the U.S. has historically been the responsibility of state and local governments. However, some producers have recently become more involved in supporting these efforts for their products and packaging.

Packaging has gained particular attention from producers in recent years in response to growing concern from regulators, consumers, and environmental researchers over the adverse economic and environmental impacts of packaging waste.

Recent research has revealed that unrecycled packaging waste contributes significantly to the problem of plastic ocean debris.[ii] Experts now assert that there will be more plastic than fish in the ocean by 2050.[iii] Research also shows that the U.S. is the only Organization for Economic Co-operation and Development (OECD) country represented in the top 20 group of contributors to marine debris.[iv] In addition, products and packaging are indirectly responsible for around 40 percent of U.S. greenhouse gas emissions and this relationship continues to be better understood.[v] Product packaging is comprised primarily of recyclable materials like paper, plastic, aluminum and glass, and comprises the largest portion of products generated in municipal solid waste, at 30 percent.[i] Research has shown the value of discarded packaging materials in the U.S. to be $11.4 billion.[vi] Many of these materials have market value, however, much of this value is lost to landfills in the U.S.

Recycling is the pathway to a secondary marketplace that provides producers with recycled feedstock to re-use in their products. Yet some feedstocks can be difficult to obtain in sufficient quantity and quality.

Recycling companies in the U.S. have been unable to supply the growing demand for recycled content by producers at competitive prices. As a result, many of these companies have faced major economic losses, threatened with bankruptcy and forced to close down facilities.[vii] Macroeconomic factors underlie this trend, namely the slowing economy in China, which buys half or more of U.S. curbside collected materials, and plummeting crude oil prices, which reduce the cost of virgin materials compared to recycled materials.[viii] Flaws in the U.S. domestic recycling system are also a key factor, which together with global trends culminate in a marketplace failure. Problems with the U.S. recycling system can be summarized in terms of the following five key barriers:

1. Limited Access to Recycling Collection

Collection is a key point of material loss in the U.S. recycling system. About 50 percent of the overall packaging generated by weight is collected for recycling, however collection rates for glass, non-corrugated paper, plastics and mixed products are substantially lower, with the majority of these materials discarded and sent to landfills. Rural areas have little or no access to public collection services. In addition, lack of access to recycling bins is a problem across the U.S., even where collection services are available. Often bins are not available in public places and commercial areas, which is a problem since people in the U.S. are very mobile across long distances, with many products consumed in numerous locations throughout the day.

“With the exception of dense, urban areas, the material that people consume in the U.S. is widely dispersed, making it more challenging to collect than if people consumed products in concentrated areas at more regular times, as is more so the case in Europe.” — Tim Brown, CEO of Nestle Waters NA

2. Contamination of Recycled Content

Once materials are collected for recycling, further material losses occur as the result of contamination of the recycling stream. U.S. recyclables have relatively high levels of contamination, which reduces the quality and aftermarket value of these materials. Glass, food waste, and mixing of non-recyclable materials are key problem areas. Contamination has grown with single stream recycling, which now represents almost two-thirds of recycling programs in the U.S.[i] Studies show that single stream systems collect notably larger volumes of recycled materials than other systems.[ix] However, this comes at the expense of lower quality from the commingling of pure streams and associated consumer carelessness and confusion when recycling.[x] Contamination can lead to rejected loads at recycling facilities both domestically and abroad. Studies show that 10 percent of loads are rejected at U.S. facilities.[xi] China’s recently implemented Green Fence policy has led to the rejection of 10 percent to 30 percent of U.S.-exported recyclables that are too contaminated and low quality.[viii]

3. Further Advancements in Recycling Technology

Even if materials are collected and loads are accepted, further material losses occur during processing by recyclers. Studies show that loss rates of 10 percent to 25 percent occur at single stream material recovery facilities (MRFs), the combined result of contamination and lagging technology.[xii] While MRFs are technologically advanced and process the majority of recyclables in the U.S, experts identify label separation, film plastics, and mixed products like aseptic containers as key challenge areas that can enhance the processing of recyclables if successfully addressed.

Additionally, there are many commercial recycling industry operators in the U.S. that are small companies with low-tech, manual sorting, which could lead to increased contamination or landfill disposal of recyclables.[xiii] Additionally, the rapidly changing “evolving ton,” which consists of a growing variety of plastic polymer combinations and mixed material products, can pose additional challenges to properly separate materials at MRFs while developing end markets for such materials. Beyond recycling facilities, the quality of recyclable materials deemed acceptable by end users can also result I additional losses in the circular system.

4. Misaligned Policy Incentives

Economic incentives and policies work against secondary markets for recycled materials. Policies and pricing structures often focus narrowly on collection rates to meet state and local goals vs. the quality of the material that comes out of the bin at the end. Pricing contracts for recycling are typically weight-based, just like landfill contracts, and do not vary based on the value of the materials included, as commodity contracts do. These weight-based contracts also do not provide incentives to reduce contamination. In addition, the abundance of cheap land for landfills in the U.S. and policies that allow for low landfilling fees mean that materials are often directed towards landfills. Further, the U.S. also lacks tax disincentives to landfill as are in place in many countries in Europe.

“The average landfill [tip] fee in the U.S. is about $45 per ton, which is substantially lower than in Europe. This drives a lot of behavior.” — Susan Robinson, Federal Public Affairs Director at Waste Management (WM)

5. Packaging Design

Producers continually launch new packaging designs that disrupt the recycling system. Mixed material packaging, such as aseptic cartons, combines different materials in layers bound together with non-removable adhesives and contaminated with inks and dyes. This practice degrades individual material quality and makes products costly and complicated to recycle. Packaging materials with higher market value, like aluminum, corrugated cardboard, and polyethylene terephthalate (PET) add value to the system. Other materials, such as polystyrene (PS), have little value and no aftermarket value, which puts a strain on recycling systems when these materials must be sorted out and discarded. Producers that use higher value materials have a built-in incentive to recover and reuse these materials. However, producers often use cheaper, low-value, or mixed materials to meet competing objectives like product safety, shelf life, and marketing.

“Design and sourcing are pretty underrepresented with the exception of recycled content. Brands want more recycled content, but in order to get it, the packaging has to first be recyclable.” — Nina Goodrich, Director of the Sustainable Packaging Coalition

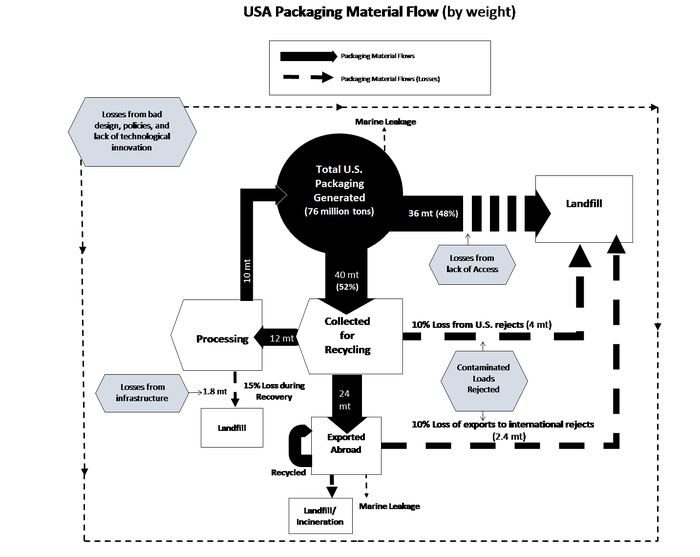

Figure 1 summarizes U.S. material flows for packaging, aggregated across packaging material types (glass, plastic, paper, and other). Data for these flows was derived from public sources, academic literature, and industry news articles. Starting with total packaging generated, this diagram depicts packaging material flows, and is meant to provide a big-picture view of the recycling system and where losses, defined as unnecessary or undesired disposal of recyclables, occur. The largest losses occur at the point of collection; however, additional losses occur after materials have been collected for recycling. Ultimately only an estimated 1/4th of the material collected for recycling is available for re-processing and selling in the U.S. recycling market, with the rest sent overseas or lost to landfill at various points in the system.

Figure 1: U.S. Packaging Material Flow Analysis

Tristanne Davis is recipient of a Carl J. Apicella Scholarship from the Environmental Research & Education Foundation. Her Master’s research at Yale University has focused on the evolving role of business in solid waste management.

Notes:

[i]Environmental Protection Agency (EPA) (2015). Advancing Sustainable Materials Management: Facts and Figures 2013. Assessing Trends in Material Generation, Recycling and Disposal in the United States. June, 2015.

[ii] The Ocean Conservancy. 2015. “Stemming the Tide: Land-based strategies for a plastic-free ocean.” McKinsey Center for Business and Environment.

[iii] The World Economic Forum (WEF), Ellen MacArthur Foundation and McKinsey & Company. 2016. “The New Plastics Economy: Rethinking the future of plastics.” Part of Project Mainstream. Accessible here.

[iv] Jambeck, Jenna R., Roland Geyer, Chris Wilcox, Theodore R. Siegler, Miriam Perryman, Anthony Andrady, Ramani Narayan, and Kara Lavender Law. 2015. “Plastic waste inputs from land into the ocean.” Science Magazine 347: 6223. February 13.

[v] Fitzgerald, Garrett C., Jonathan S. Krones, and Nickolas J. Themelis. 2012. “Greenhouse gas impact of dual stream and single stream collection and separation of recyclables.” Resources, Conservation and Recycling 69: 50–56; Stolaroff, Joseph (2009). Products, Packaging and US Greenhouse Gas Emissions. Product Policy Institute, White Paper. September 2009; US Environmental Protection Agency (EPA). 2013. “Greenhouse Gas Sources and Sinks 1990–2011.”

[vi] MacKerron, Conrad. 2012. “Unfinished Business: The Case for Extended Producer Responsibility for Post-Consumer Packaging.” As You Sow.

[vii] Gelles, David. 2016. “Skid in Oil Prices Pulls the Recycling Industry Down with it.” The New York Times, February 12.

[viii] CalRecycle. 2014. “2013 California Exports of Recyclable Materials.” CA Department of Resources, Recycling and Recovery, August 2014. Royte, Elizabeth. 2013. China’s Too Good for Our Trash. Yay? Onearth. October 23, 2013.

[ix] Pressley, Phillip N., Levisa, James W., Damgaardb, Anders, Barlaza, Morton A., and Joseph F. DeCarolisa. 2014. Analysis of material recovery facilities for use in life-cycle assessment. Waste Management. Volume 35, January 2015, Pages 307–317.

[x] Groden, Claire. 2015. “The American recycling business is a mess: Can Big Waste fix it?” Fortune Magazine. September 3, 2015.

[xi] Olie, Andrew and Joanne Wood. 2015. “Hit Or Miss?” CIWM Journal. July 2015.

[xii] RRS. 2015. “MRF Material Flow Study.” Final Report, July 2015.

[xiii] IBIS World. 2016. “Recycling Facilities in the US: Market Research Report.” IBISWorld’s Industry Research Reports. April 2016.

About the Author

You May Also Like