Dropping Beverage Container Redemption Rates Signal Need to Revamp Bottle Return Programs

New data released by the Container Recycling Institute (CRI) shows which states saw lower participation in beverage container redemption programs.

August 31, 2023

Container Recycling Institute

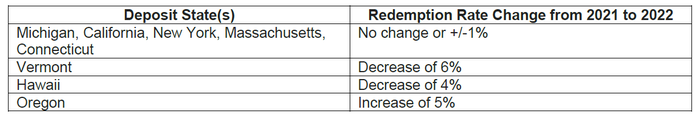

Beverage container redemption rates for 2022 in seven of the eight U.S. bottle bill states with available data either dropped or remained within +/-1% compared to 2021. Oregon is the only state that saw a noticeable increase from 2021 to 2022.

Of the 10 deposit states, all but Maine and Iowa have currently available data. Overall findings from CRI’s data compilation include the following (see the chart at the end of this document for complete details)

“Stagnant or dropping redemption rates point to the need for program modernizations – such as higher container deposit amounts, coverage of more beverage types, and additional convenient options for consumers to return bottles and cans. Several bottle bill states still do not include deposits on noncarbonated drinks, including bottled water – sales of which have skyrocketed since the deposit return systems were implemented in the 1970s and ’80s," said CRI President Susan Collins.

She also noted that program modernizations passed in California and Connecticut should lead to increases in the volume of bottles and cans redeemed as the new provisions take effect. However, changes in the actual redemption rates – number of containers redeemed as a percentage of number on deposit sold – can lag given the time needed for more consumers to learn about these changes and adjust their behavior to return newly eligible bottles and cans for the deposit refund.

California:

SB 1013: Adding deposits to wine and distilled spirits (5 cents for containers less than 24 oz. and 10 cents for those 24 oz. or larger) effective Jan. 1, 2024. A CRI analysis indicates this will result in the recycling of more than half a billion additional bottles and cans annually, or more than 300,000 tons of material that had previously been destined for the landfill.

AB 179 (budget bill): Providing nearly $400 million in new spending for the bottle bill program, including (among other items) startup funds for recycling and processing centers, and extra funding for bag drops, mobile recycling and reverse vending machines (RVMs).

In addition, the California State Senate has passed a bill (SB 353) to add 100% fruit juices and vegetable juices to beverages on deposit. If it is held over until 2024 (the second year of the state’s current two-year legislative cycle), it still must go through several steps in the legislative approval process. According to CRI’s analysis, passage of this bill would place a deposit on an estimated 188 million new containers, in addition to the 18.4 billion existing containers covered.

Connecticut (SB 1037 for all items):

Added deposits to noncarbonated beverages, hard cider and malt-based hard cider effective Jan. 1, 2023, for a 13% increase in overall beverage unit coverage.

Provided a handling fee increase for retailers and redemption centers, which generated enough revenue to encourage the opening of new centers, plus funding for retailers to install RVMs. The RVM mandate at certain chain stores resulted in more than 300 new redemption locations in the state.

Increasing the deposit amount on eligible containers from 5 cents to 10 cents effective Jan. 1, 2024. In 1980, when Connecticut’s bottle bill took effect, a nickel was worth what about 20 cents is today. A nickel is clearly no longer an adequate incentive for container returns. When Oregon increased its deposit from 5 to 10 cents, the redemption rate climbed 22% in just three years.

Significant bottle bill reforms also are occurring in Maine. The 2023 passage of LD 134 increased the handling fee for redemption centers to keep them financially viable. Another new law, LD 1909, will streamline the container sorting process for redemption centers; establish a “commingling cooperative” of beverage manufacturers to coordinate the pickup of and payment for redeemed bottles and cans; and redirect unredeemed deposits from beverage companies to a fund used for program improvements.

In addition, in two other bottle bill states – Vermont and Massachusetts – passage of deposit return program modernization legislation remains a possibility.

In Vermont – where the redemption rate dropped 6% from 2021 to 2022 – both the State House of Representatives and State Senate passed legislation (H.158) earlier this year that would expand deposit coverage to most beverage types (at 5 cents), as well as wine at 15 cents. It also would require more redemption centers to serve consumers. Although Gov. Phil Scott vetoed the bill, the General Assembly has the opportunity to override the veto when it reconvenes in January.

Massachusetts continues to sit last among bottle bill states with an extremely low redemption rate of 38%, with one reason being that only 40% of beverage types currently are on deposit. A bill (H.3690) introduced for the 2023-2024 legislative cycle would expand the bottle bill to include more types of beverage containers and increase the deposit from 5 cents to 10 cents. CRI estimates that these upgrades would result in the recycling of more than 3 billion additional bottles and cans annually over and above what is now recycled.

Collins noted it’s important to remember that Massachusetts’ current disappointing redemption rate is still higher than the U.S. nominal recycling rate of 24% for beverage containers not on deposit, adding that even outdated deposit return systems perform better than non-deposit ones.

U.S. Comparisons to International Deposit Return Systems

Outside of the U.S., the adoption of beverage container deposit return systems (DRS) continues to grow at a skyrocketing pace, as more and more governments recognize these programs’ value in dramatically increasing recycling rates, thus helping to address the global plastic pollution and climate crises.

At the end of 2022, approximately 444 million people in 44 jurisdictions across the globe were covered by a DRS. With the expected implementation of already-announced laws, and the potential approval of a packaging regulation covering the entire EU, that number could increase to just over 1 billion by decade’s end.

Collins said that most non-U.S. jurisdictions operate programs with higher deposit amounts and more beverage container coverage than U.S. states, adding that these governments do not wait for redemption rates to drop below 60% before upgrading their programs. In the U.S., of the bottle bill states with available data, four have rates at or below the 60% threshold.

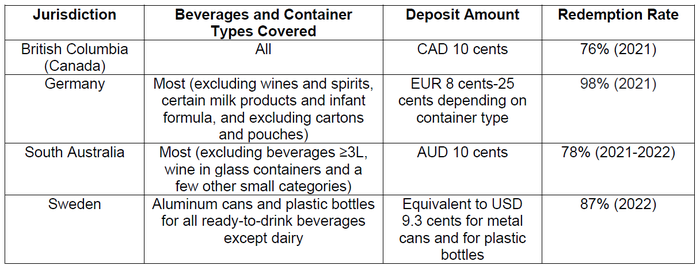

By comparison, a look at a handful of international programs shows the following:*

Collins said, “Given the success of beverage container deposit return systems worldwide, all signs now point to a national bottle bill in the U.S. becoming a reality. But in the meantime, it’s critical to work on the passage, implementation and expansion of state bottle bills to improve recycling rates and further contribute to increases in circularity.”

*(For more detailed data on U.S. and international DRS programs, visit www.bottlebill.org and click on “Existing Programs.”)

The nonprofit Container Recycling Institute (www.container-recycling.org) is a leading authority on the economic and environmental impacts of used beverage containers and other consumer product packaging. Its mission is to make North America a global model for the collection and quality recycling of packaging materials.

You May Also Like