The continued decline in market values for recycled commodities drove a revenue decline of $86 million and presented a more significant headwind in the quarter than anticipated.

Houston-based Waste Management, Inc. (WM) reported revenues of $3.97 billion for the third quarter of 2019, which is up from $3.82 billion for the same 2018 period. Despite this positive, the company experienced a larger-than-expected recycling headwind that resulted in a revenue decline of $86 million.

According to John Morris, chief operating officer for Waste Management, the $86 million decline was partially due to the fact that the company’s blended average commodity price in Q3 2019 was just under $40 per ton, a decline of 40 percent compared to last year and a further 8 percent decline from the 10-year low reached in Q2 2019. “Despite this precipitous drop, the steps we're taking to improve the recycling business held year-over-year decline to operating EBITDA to $7 million and EPS decline to about $0.01,” he said.

Adding to Morris' comments, Jim Fish, CEO and president of Waste Management, said, "The good news is that the steps we're taking to transform the recycling business with restructured fee-based contracts and investments in technology will insulate the business from commodity price swings, and we're starting to see results. We saw a 320-basis point improvement in contamination rates at our single stream MRFs [materials recovery facilities] in the third quarter.”

On the collection and disposal side of the business, Waste Management continued to see positive results.

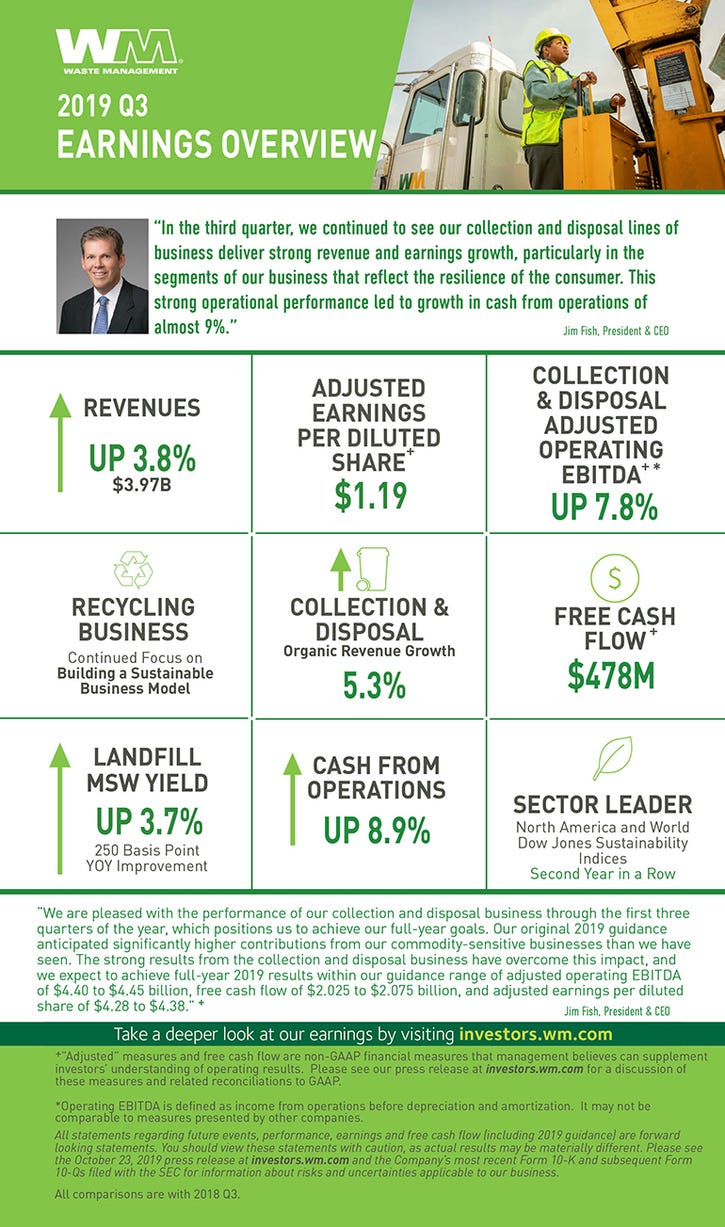

“In the third quarter, we continued to see our collection and disposal lines of business deliver strong revenue and earnings growth, particularly in the segments of our business that reflect the resilience of the consumer,” said Fish in a statement. “This strong operational performance led to growth in cash from operations of almost 9 percent.”

“Overall, our collection and disposal business has performed exceptionally well in 2019, overcoming headwinds in our commodity-sensitive businesses, recycling and renewable energy,” said Fish on a call with investors. “The results in our commodity-sensitive businesses, which make up less than 10 percent of our total revenue, have been below our expectations. We've discussed all year the historically low recycling commodity prices, but we've also seen a negative $18 million impact in our operating EBITDA plan through the first nine months of the year related to renewable natural gas credits.”

Waste Management has been investing in its renewable energy business to close the loop between its landfill gas and compressed natural gas (CNG) fleet, according to Devina Rankin, chief financial officer of Waste Management.

“Our capital expenditure guidance excluded the potential increase in renewable energy capital given the uncertain timing of the potential investments,” she said on a call with investors. “Because pricing for RINs [renewable identification numbers] declined significantly in 2019, we didn't make as large as an investment as we might have otherwise. Full-year capital spending for renewable energy plants is expected to be between $35 million and $40 million.”

Rankin added that Waste Management also made deliberate investments in its fleet, bringing the percentage of garbage trucks running on natural gas to about 60 percent and increasing the number of automated side loaders in the fleet by about 9 percent.

Waste Management also provided an update on the pending acquisition of Advanced Disposal Services, Inc., stating, “We continue to make progress toward closing this transaction, and we remain on track to complete the acquisition during the first quarter of 2020.”

Here are some additional key highlights for Q3 2019:

Total company operating EBITDA was $1.14 billion for Q3 2019, an increase of $60 million from Q3 2018. On an adjusted basis, total company operating EBITDA was $1.14 billion for Q3 2019, an increase of more than $30 million from Q3 2018.

Operating EBITDA in the company’s collection and disposal business increased $94 million, or 7.8 percent, in Q3 2019, compared to the same period last year.

Net income for the quarter was $495 million, or $1.16 per diluted share, compared with $499 million, or $1.16 per diluted share, for Q3 2018.

Organic revenue growth for Q3 2019 was driven by strong yield and volume growth in the company’s collection and disposal business, which contributed $198 million of incremental revenue.

Core price for Q3 2019 was 5.3 percent, compared to 5.4 percent in Q3 2018.

The continued decline in market values for recycled commodities, which were down 40 percent year-over-year in Q3 2019, drove a revenue decline of $86 million and presented a more significant headwind in the quarter than anticipated. As a result of continued efforts to advance a fee-for-service business model, the operating EBITDA in the company’s recycling line of business declined by $7 million, compared to the third quarter of 2018.

Operating EBITDA from the sale of renewable natural gas credits declined approximately $8 million from Q3 2018 due to lower market values.

Internal revenue growth from yield for the collection and disposal business was 2.6 percent for Q3 2019, versus 2.5 percent in Q3 2018.

Collection and disposal business internal revenue growth from volume was 3.3 percent in Q3 2019. Total company internal revenue growth from volume, which includes the company’s recycling line of business, was 2.6 percent in Q3 2019.

As a percentage of revenue, operating expenses were 61.5 percent in Q3 2019, compared to 62.1 percent in Q3 2018.

Net cash provided by operating activities was $952 million in Q3 2019, an increase of $78 million, or 8.9 percent, compared to Q3 2018.

Capital expenditures were $483 million in Q3 2019, a $79 million increase from Q3 2018, due to an intentional focus on accelerating certain fleet and landfill spending to support the company’s strong collection and disposal growth.

Free cash flow was $478 million in Q3 2019, compared to $480 million in Q3 2018.

Waste Management paid $218 million of dividends to shareholders in Q3 2019

The company spent $76 million on acquisitions of traditional solid waste businesses during Q3 2019.

The company’s effective tax rate for Q3 2019 was approximately 19.4 percent.

The company was recognized as a sector leader on the 2019 North America and World Dow Jones Sustainability Indices for the second year in a row.

Providing an update on the company’s use of technology, Fish said, “On the technology front, we began running test material through our MRF of the future and are encouraged by the results. At multiple other facilities, we're testing robotics, advanced optical sorting technology and improving the screening processes. We continue to expect a meaningful operating cost savings from these advancements in technology, while also creating the best quality material for sale through positive sorting processes.”

On a call with investors, Fish gave a nod to Waste Management’s employees, stating, “I need to give credit to our 45,000 employees out there who work really, really hard every day … No one in this industry works harder than the employees at Waste Management … As an industry, not just Waste Management, this is such a hardworking industry. It makes me proud to be here.”

Commenting on labor inflation, Morris said, “We've talked a lot about turnover and the impact that that's had on the operation and our efforts around furthering our people-first efforts. The good news is we are starting to see some turnover moderate. Wage inflation is still higher than the average for overall inflation, but the good news is we're starting to see a little bit of moderation there.”

“We are pleased with the performance of our collection and disposal business through the first three quarters of the year, which positions us to achieve our full-year goals,” said Fish in a statement. “Our original 2019 guidance anticipated significantly higher contributions from our commodity-sensitive businesses than we have seen. The strong results from the collection and disposal business have overcome this impact, and we expect to achieve full-year 2019 results within our guidance range of adjusted operating EBITDA of $4.40 [billion] to $4.45 billion, free cash flow of $2.025 [billion] to $2.075 billion and adjusted earnings per diluted share of $4.28 to $4.38.”

“As we reflect on the year so far and develop our plans for next year, a couple of trends are starting to come to light, particularly in our collection and disposal business,” said Fish on a call with investors. “Our results across the solid waste business have been strong through the first nine months of the year, but they've been particularly strong in our lines of business that are driven by the consumer portion of the economy, commercial collection and MSW [municipal solid waste] landfill volumes. We have good visibility into these segments of our business and all indicators are pointing to continued strength.”

About the Author(s)

You May Also Like