Strength of collection and disposal business drives overall revenue growth of more than 5 percent.

Houston-based Waste Management, Inc. reported that the strength of the company’s collection and disposal business was a main contributor to its success for the second quarter of 2019.

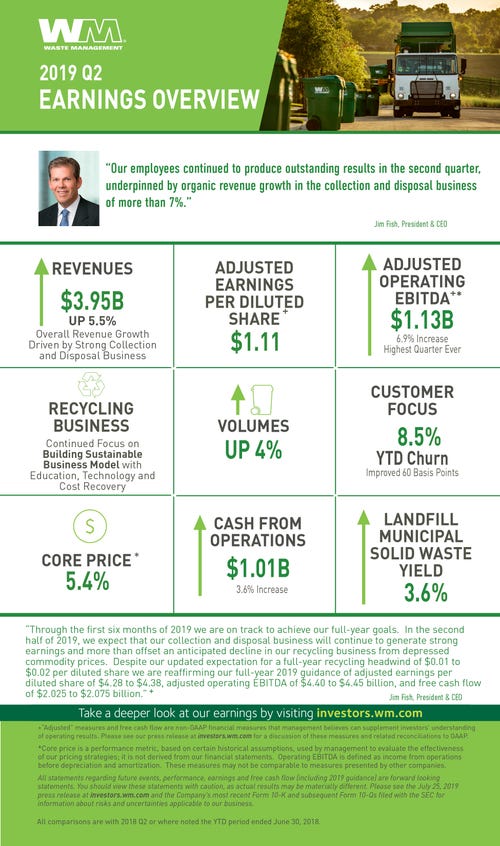

During a July 25 call with investors, Waste Management President and CEO Jim Fish explained the company had a strong core price of 5.4 percent, which translated into total company operating EBITDA of more than $1.13 billion, an increase of almost 7 percent from Q2 2018. Fish added that in the second quarter, “all indicators point to excellent health,” with operating EBITDA growth translating to free cash flow of $440 million.

Regarding the Advanced Disposal Services (ADS) acquisition, Fish pointed to the fact that at the end of June, ADS stockholders voted to approve Waste Management’s acquisition of the company.

“This stockholder approval is an important milestone in the process toward closing the transaction,” said Fish during the call. “In addition, and as expected, we received a second request from DOJ [Department of Justice Acquisition Management Bureau], and we continue to work with them to satisfy this request. We remain on track to complete the acquisition during the first quarter of 2020 as we continue our progress toward completing this transaction. We have dedicated teams working to position us to fully integrate ADS when the time comes.”

Waste Management also reported that its revenues for the second quarter of 2019 were $3.95 billion, compared with $3.74 billion for the same 2018 period. Net income for the quarter was $381 million, or $0.89 per diluted share, compared with $499 million, or $1.15 per diluted share, for Q2 2018.

“Our employees continued to produce outstanding results in the second quarter, underpinned by organic revenue growth in the collection and disposal business of more than 7 percent,” said Fish in a statement. “We leveraged growth in our collection and disposal business to expand operating EBITDA margins by 60 basis points.”

Here are some additional key highlights for Q2 2019:

Total operating EBITDA was $1.11 billion for Q2 2019, an increase of $6 million from Q2 2018. On an adjusted basis, total company operating EBITDA was $1.13 billion for Q2 2019, an increase of $73 million, or 6.9 percent, from Q2 2018.

Operating EBITDA in the company’s collection and disposal business increased $112 million, or 9.3 percent, in Q2 2019, compared to the same period last year.

Revenue growth for Q2 2019 was driven by strong yield and volume growth in the company’s collection and disposal business, which contributed $230 million of incremental revenue. This was partially offset by a $38 million year-over-year decline in revenue from the company’s recycling line of business.

During the call with investors, John Morris, Waste Management’s chief operating officer, said there was a $21 per ton, or 33 percent, year-over-year drop for average commodity prices. “We are very pleased with our team’s hard work for restructuring contracts and assessing fees for contamination,” he noted. “Looking at the remainder of the year, we anticipate that commodity prices will continue to be well below the $70 per ton commodity price levels. As a result, we no longer anticipate a full-year tailwind for recycling. We now expect that our recycling business will be a 1-cent to 2-cent headwind for the full year. We remain focused on changing the business model for recycling with improved MRF [materials recovery facility] technology and contract structure to improve our processing costs and protect us from a commodity price downturn. To that end, we are on track to open a recycling plant of the future by the end of this year. With this plant, we expect to see labor and cost operating savings by processing the best quality commodity for sale.”

Internal revenue growth from yield for the collection and disposal business was 2.7 percent for Q2 2019, versus 2.3 percent in Q2 2018.

Collection and disposal business internal revenue growth from volume was 4.4 percent in Q2 2019. Total company internal revenue growth from volume, which includes the company’s recycling line of business, was 4 percent in Q2 2019.

Operating EBITDA in the company’s recycling line of business improved by $6 million, compared to Q2 2018, despite a $38 million decline in revenue. Waste Management said it was able to overcome pressure from a 33 percent year-over-year drop in recycling commodity prices by working to develop a “sustainable business model that also meets customers’ environmental needs.”

As a percentage of revenue, operating expenses were 61.9 percent in both Q2 2019 and 2018. On an adjusted basis, operating expenses were 61.5 percent for Q2 2019.

Net cash provided by operating activities was $1.01 billion in Q2 2019, an increase of $35 million, or 3.6 percent, when compared to Q2 2018. The growth in net cash provided by operating activities was driven by operating EBITDA growth and the company’s focus on improving working capital, partially offset by higher taxes and interest.

Capital expenditures were $578 million in Q2 2019, a $142 million increase from Q2 2018, due to an intentional focus on accelerating certain fleet and landfill spending to support the company’s strong collection and disposal growth.

Free cash flow was $440 million in Q2 2019, compared to $621 million in Q2 2018. The decline in free cash flow was primarily driven by the increase in capital expenditures in the quarter attributable to year-over-year timing differences in fleet and landfill spending and a reduction in proceeds from divestitures.

Waste Management paid $217 million of dividends to shareholders and repurchased $180 million of its shares in Q2 2019.

The company spent $48 million on acquisitions of traditional solid waste businesses during Q2 2019.

The company’s effective tax rate for Q2 2019 was approximately 23.3 percent.

“Through the first six months of 2019 we are on track to achieve our full-year goals,” said Fish in a statement. “In the second half of 2019, we expect that our collection and disposal business will continue to generate strong earnings and more than offset an anticipated decline in our recycling business from depressed commodity prices. Despite our updated expectation for a full-year recycling headwind of $0.01 to $0.02 per diluted share we are reaffirming our full-year 2019 guidance of adjusted earnings per diluted share of $4.28 to $4.38, adjusted operating EBITDA of $4.40 to $4.45 billion and free cash flow of $2.025 to $2.075 billion.”

During the call, Fish also emphasized that the company continues to invest in its people, technology, customer experience and asset network. On both the technology and customer experience fronts, in June, the company launched an upgraded website that allows customers to order and manage service with modernized applications and increased functionality.

Additionally, Waste Management opened a second driver and technician training facility in Glendale, Ariz., in June and continues to expand its program with Caterpillar for automated equipment for landfill operations, added Fish.

“While this is a technology investment, it is also an investment in our people, as technology like this modernizes the job for our workers, improves safety, enables us to work more efficiently and provides us with opportunities to expand our workforce in the future,” he said.

About the Author(s)

You May Also Like