On Monday, Waste360 published an article after reconnecting with Hamzah Mazari, Managing Director from Jeffries. He spoke about the economic effects of COVID-19 and what the second half of 2020 could look like for waste and recycling.

This is an update from a report Jeffries recently released sharing their proprietary consumer surveys for June. Read on to gain insights into the rest of 2020 and what the first half (1H) of 2021 holds.

Jeffries reports that according to its commercial waste survey, commercial volume recovery is coming in faster than expected barring another lockdown, which is positive for the space. Having said that, Jeffries still prefers names with mergers and acquisitions (M&A) catalysts and superior pricing with less potential residential work from home (WFH) margin impact. Waste Connections (WCN) and Casella (CWST) stack up better than Republic Services (RSG) and Waste Management (WM) for now.

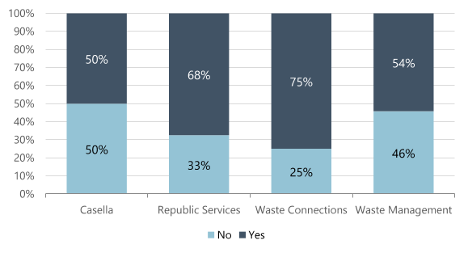

Figure 1: If you reduced or discontinued waste service, have you since asked for a service increase?

Source: Jefferies Proprietary Survey

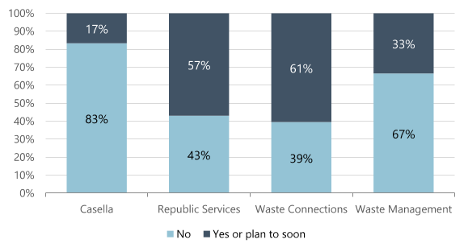

Figure 2: Have you discontinued waste service or asked for service decrease?

Source: Jefferies Proprietary Survey

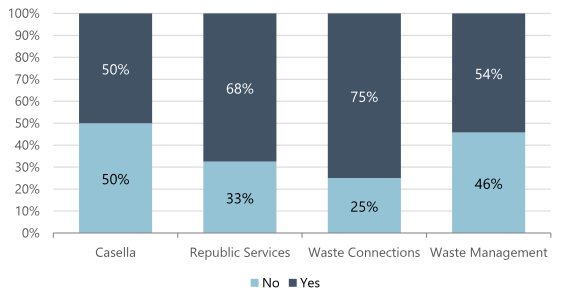

Figure 3: If you reduced or discontinued waste service, have you since asked for a service increase?

Commercial Survey Suggests the Recovery in Commercial Volume Looks Better Than Expected.

Jeffries did a second round of surveys with 500 respondents in mid-June (first round was early April) to get a sense of how commercial waste volumes could be trending. Of the 500 respondents surveyed, 400 were customers of the public solid waste companies (WM, RSG, WCN, CWST).

These results suggest that 62 percent of small businesses that reduced or discontinued service have asked for service increases, which indicates the recovery in commercial volume is coming in better than expected. This is also consistent with states reopening, better than expected employment gains in May on the back of construction, hospitality and leisure, and better than expected retail sales in May.

As Mazari mentioned in the previous article, the Jeffries’ economist commentary is consistent with the trends of sequential improvement as U.S. small business activity (measured by total employee hours) has retraced 60 percent of its decline and 40 percent of previously closed retail locations have reopened.

Prefer Names with M&A Catalysts (WCN, CWST)

Although commercial volume is rebounding, Jeffries warns that it does not think that we will see positive volume until the first half (1H) of 2021 for the sector. In terms of the stocks, Jeffries prefers WCN and CWST which are names where there is M&A “pent-up demand” post COVID-19 and where the residential margin pressure (on the back of greater WFH dynamics) is limited due to various offsets (more subscription mix, more franchise/exclusive contracts).

Brunt of Residential Margin Impact to be Felt in Q2 (Impacts WM/RSG More)

It is also worth noting that the brunt of the residential margin impact is likely to be seen in Q2 given “full shutdown” impact being more pronounced. It would also not surprise Mazari to see at least 50bps margin pressure from the majors or more due to weaker municipal residential profitability. The renegotiation of these contracts is not a short process, can be complicated and can last a number of years. As the sector saw with recycling, the process can take three years and still not be 100 percent complete.

Overall pricing trends continue to hold up

It will be interesting to see if landfill pricing ramps up in Q2 of 2021 given the counterbalance between higher industry discipline and lower industry volume tonnage.

Please see original Economic Outlook for the Second Half of 2020 article here.

About the Author(s)

You May Also Like